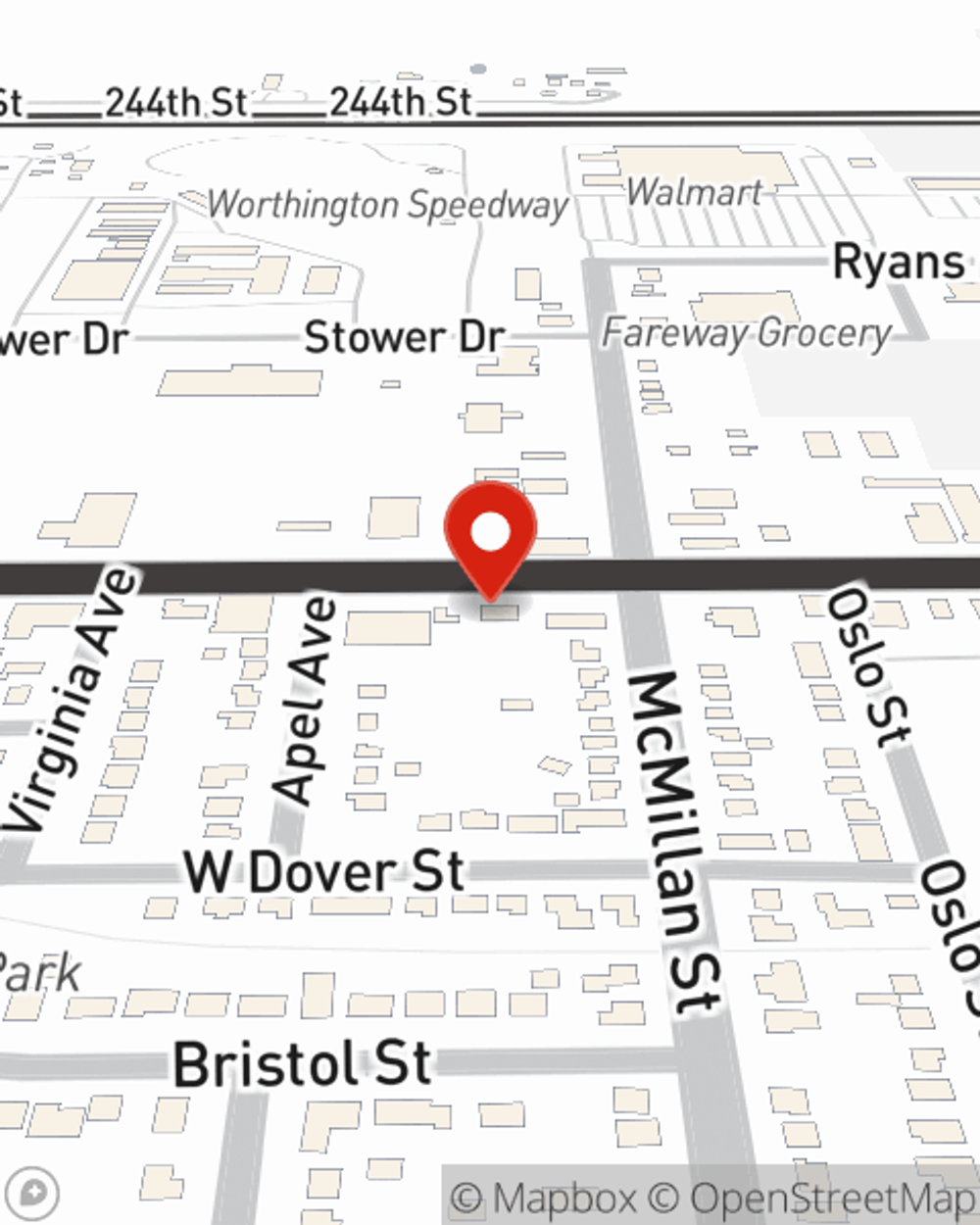

Business Insurance in and around Worthington

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Insure The Business You've Built.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jason Vote help you learn about your business insurance.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Get Down To Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your pay, but also helps with regular payroll costs. You can also include liability, which is critical coverage protecting your financial assets in the event of a claim or judgment against you by a customer.

Visit the terrific team at agent Jason Vote's office to help determine the options that may be right for you and your small business.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Jason Vote

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.